Early-stage M&A is not something people talk about in public, but many are thinking about it, especially in the bloodbath of AI. Last week, I hosted a candid "Founder to Founder" conversation featuring Divyansh Saini, who successfully sold his startup Houseware, to provide 50 fellow entrepreneurs with unfiltered insights into the early-stage M&A process.

Whether you're actively considering an exit or simply preparing for future possibilities, understanding the mechanics and psychology of acquisitions can help you make strategic decisions throughout your company's lifecycle. Selling your seed/Series A startup is not necessarily a bad thing. If you can’t raise another round of funding and generate enough revenue to raise money again, then it’s better to be honest with yourself and sell. The investors will be happy to recycle whatever money they get back. Here's what founders need to know about navigating the complex world of early-stage M&A:

Companies are bought, not sold – Focus on building novel technology, exceptional talent, or market positioning that larger companies can't easily replicate themselves.

Build relationships before you need them – Maintain ongoing connections with CEOs and CPOs of adjacent companies; the strongest acquisition signal comes when a CEO reaches out personally.

Know when it's time – Consider selling when: technology is moving faster than you can adapt, competition is developing similar solutions, customers are shifting to competitors, or fundraising is becoming challenging.

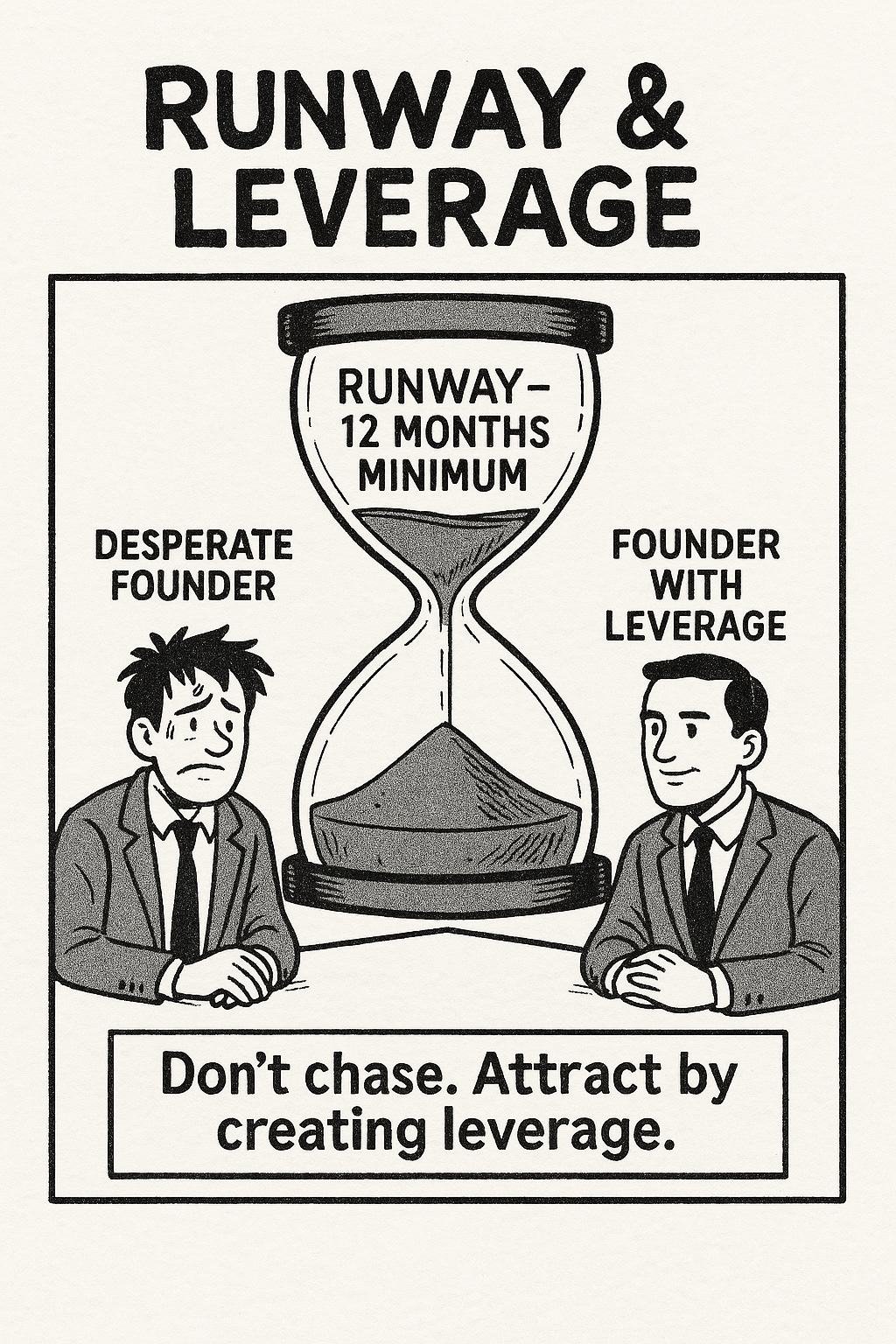

Ensure proper runway – Start with 9-12 months minimum runway when beginning the M&A process; deals take longer than expected and operating from desperation reduces leverage.

Align with co-founders early – Discuss exit scenarios with your founding team before they arise; if co-founders aren't aligned on selling, acquirers will notice during diligence and deals will likely fail.

Fundamental Principles: Companies Are Bought, Not Sold

The most important reality to understand about early-stage M&A is that companies are bought, not sold. As Divyansh emphasized, larger enterprises have priorities set at the beginning of each year or quarter, and it's extremely difficult for a smaller company to change those priorities.

What does this mean for founders?

Focus on creating unique value, not just revenue. Early-stage M&A rarely centers on Annual Recurring Revenue (ARR). For larger companies, adding a few million in ARR can be achieved simply by hiring more sales representatives. Even companies with around $10M ARR (typically Series A/B stage) don't get valued much above their revenue in acquisitions.

Instead, acquisitions typically focus on:

Novel technology that larger companies can't easily replicate

Team expertise and talent in specific domains

Strategic market position or technological edge

This perspective shift is critical - rather than focusing exclusively on growth metrics that appeal to investors, consider what unique capabilities your company has that would be difficult for a larger company to build internally.

Building Strategic Relationships for Future Acquisitions

Unlike fundraising, where there's a clear process and timeframe, M&A often results from long-standing relationships and strategic positioning. Successful founders maintain ongoing dialogue with potential acquirers long before considering an exit.

How to build these relationships:

Connect with adjacent players - Regularly meet with CEOs and CPOs of companies operating in similar or adjacent spaces

Exchange learnings without revealing core IP - Find ways to add value through industry insights without giving away your secret sauce

Understand Corporate Development signals - Learn to interpret interest levels:

Softest signal: Corp Dev reaching out for "partnerships"

Medium signal: CPO reaching out directly

Strongest signal: CEO reaching out personally

As one participant noted, "You cannot be part of that option or have them reaching out if they don't know you exist." This highlights the importance of visibility - whether through relevant communities, social media, or strategic partnerships with shared customers.

Remember: Corporate Development typically talks to 30+ companies simultaneously while collecting market intelligence, with only 2-3 advancing to serious discussions. Make sure you're positioning yourself to be among those select few.

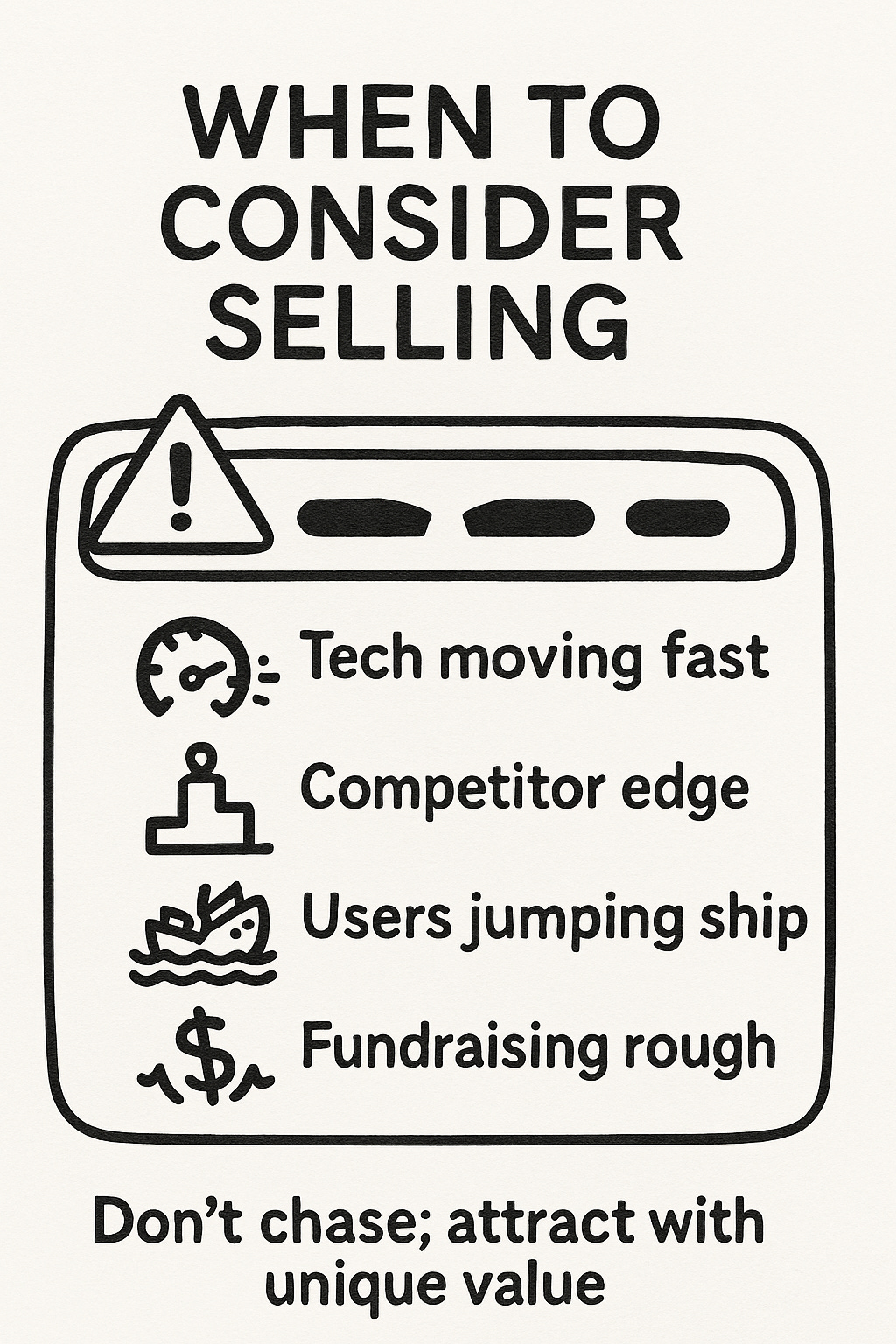

Recognizing When to Sell: The Four Key Indicators

Timing is everything in M&A. While there's no one-size-fits-all formula for the perfect moment to sell, our conversation highlighted four critical indicators that suggest it might be time to explore an exit:

Market or technology moving faster than your company can adapt

Competition developing similar technology that threatens your advantage

Customer adoption shifting to competitors

Fundraising becoming challenging (unable to raise desired amount/terms)

In Divyansh's case, all four indicators became apparent in early 2024. A public competitor was preparing to launch similar technology, potential pivot directions would require significant runway, and fundraising conditions weren't ideal for achieving the best outcome.

Runway considerations are crucial. You need 9-12 months minimum runway when starting the M&A process, as deals take longer than founders typically expect. Operating from a position of desperation dramatically reduces your leverage.

Navigating the M&A Process Effectively

Once you decide to explore an exit, the process requires strategic thinking and patience:

1. Create a comprehensive target list

Include non-traditional buyers (companies not known for technology or organizations looking to build new capabilities)

10-15 primary targets, 20-30 secondary options

2. Make direct outreach when possible

Reach out directly to CPOs/CEOs when you have relationships

For early-stage deals ($10M-100M), bankers typically add limited value

3. Understand what buyers truly value

Be realistic about what parts of your business are most valuable

For Houseware, despite building a comprehensive product, the acquirer was primarily interested in their warehouse query engine

4. Create leverage in negotiations

Build urgency through competitive dynamics

Align with the buyer's vision and strategic priorities

Avoid contradicting their market thesis

5. Prepare for the timeline

The process takes several months from initial discussions to close

No deal is secure until final papers are signed

The Psychology of Selling Your Company

Beyond the mechanics, there's an important psychological dimension to selling your company. As Divyansh described it, "It's a jarring shift. You were so proactively looking to scale these things and build the product... Now you're like, 'Hey, I have to do the right thing for my team, my investors, myself.'"

This is where founder alignment becomes critical. If co-founders aren't on the same page about selling, the process is unlikely to succeed. One participant shared a cautionary tale: "I've seen founders where they didn't agree both to sell... It was very obvious that [one] doesn't want to sell. And it came across in diligence, and when the acquirer met them... If you don't both want to sell, you're not going to land the plane."

Key Takeaways for Founders

Start relationship-building early - Don't wait until you're considering an exit to connect with potential acquirers

Focus on unique value creation - Build technology and expertise that's difficult for larger companies to replicate

Monitor market signals - Stay alert to the four key indicators that might suggest it's time to sell

Maintain adequate runway - Ensure you have 9-12 months of runway before starting the process

Align with co-founders - Have frank discussions about exit scenarios before they arise

As one founder participant aptly put in their feedback: "What's the ideal time to determine when it's the right moment to exit? I understand it's a very subjective answer and will depend on a case-by-case basis, but how early is too early and how late is too late?"

While there's no universal answer to this question, the frameworks shared in our conversation can help you recognize the signals and make informed decisions when the time comes. My personal perspective is that when founders run out of ideas to try, then it’s time to pivot, or sell, or shut down. That’s because creativity is fueled by passion and when the passion dies, the force of the founding team and the energy that’s needed to succeed is going to end, even if there is money still left in the bank. As I share with all founders, I’m just one data point. If you have a different perspective, please comment or reach out to chat more.

And remember Divyansh's powerful metaphor: "Very few founders land the plane. A lot of founders abandon the plane." Preparing for a potential M&A scenario is about ensuring you have the skills, relationships, and runway to successfully land the plane when the time is right.

This blog post is based on insights from our "Founder to Founder" conversation featuring Divyansh Saini, who sold his startup Houseware. If you found this valuable, join our upcoming events where we'll continue to share transparent founder experiences on crucial but rarely discussed topics.Next on is on making at the top of the list on Hacker News, with a founder who did it more than 10 times, CEO of Lago https://lu.ma/3loq2b6e

Great, and timely, insights. Thanks!

Scary Truth :) Love the message and graphics